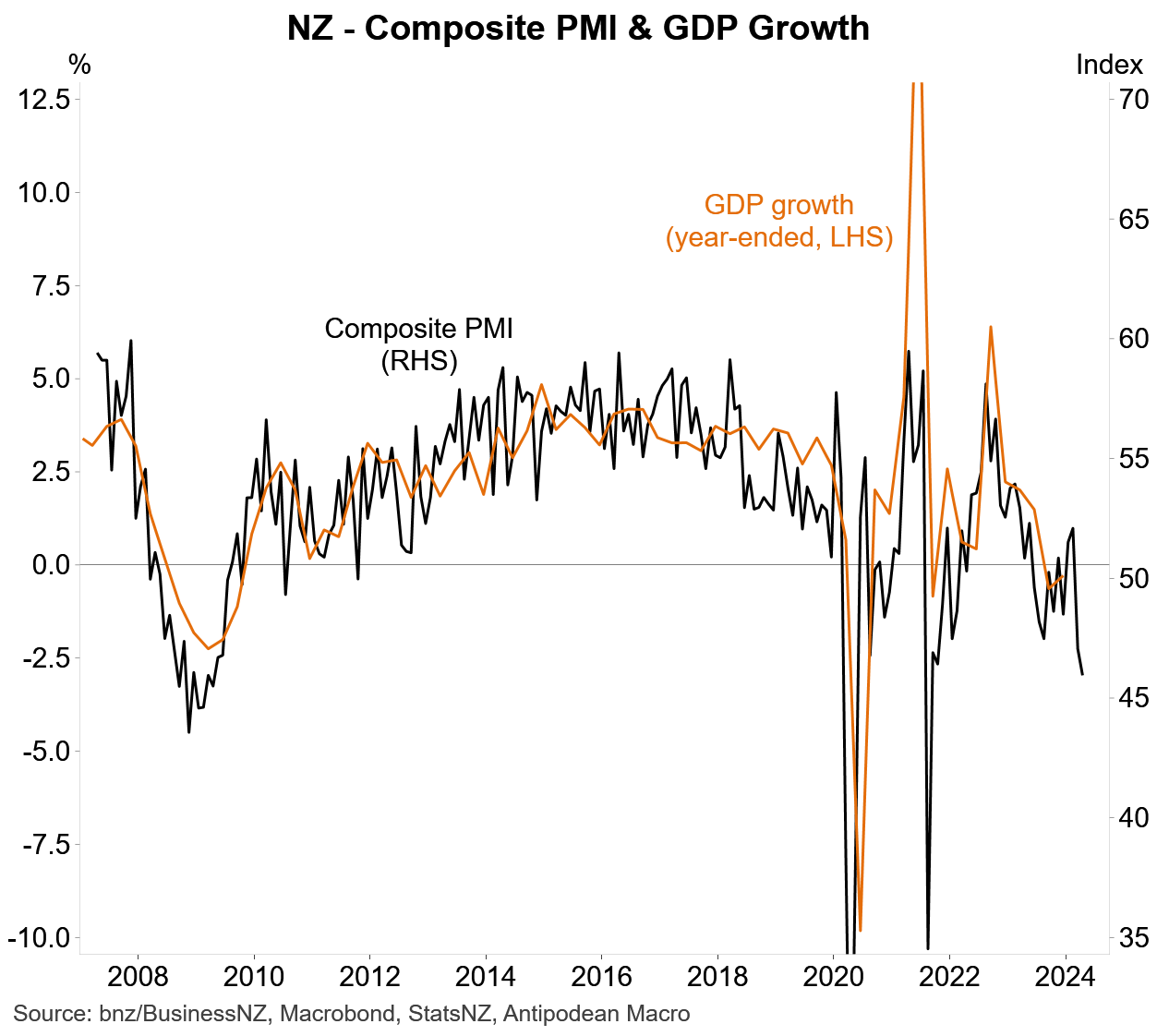

1. New Zealand’s composite PMI weakened again in April.

Things are starting to look increasingly ugly for the NZ economy.

2. Food prices rose +0.6% m/m in New Zealand in April (in original and seasonally adjusted terms). This was the first rise in four months in seasonally adjusted terms.

In annualised 3m/3m terms, food inflation remained negative, held down by large falls in fruit & vegetable prices. In contrast, inflation for groceries, eating out and non-alcoholic beverages has lifted again.

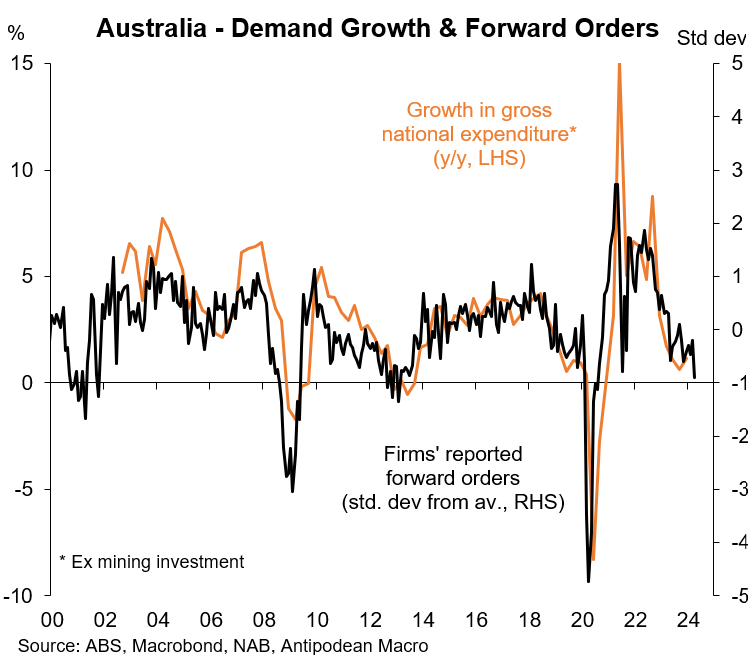

3. Today’s Aussie NAB business survey will have been met with a collective sigh of relief by the RBA - slower signals for activity, employment, labour coasts and inflation.

Australian firms reported weaker forward orders in April, consistent with ongoing weak growth in domestic demand.

4. Aussie firms also said that their hiring in April slowed to around average levels…

5. Overall capacity utilisation for Aussie businesses was broadly unchanged in April but has gradually eased for 2 years now.

6. Growth in private-sector labour costs in Australia continued to slow in April...

…which is also a positive signal for further slowing in domestic services inflation.

7. Overall output price inflation in Australia was reported to have ticked up slightly in April but the trend has been lower. Growth in purchase costs slowed further.

8. The noisy retail inflation indicator from the NAB business survey declined in April after picking up in prior months.

9. Aussie firms’ reported profitability has been easing for well over a year but remained above average in April.

10. At the same time, Aussie firms reported that their capex has picked up again since the start of this year.

Discussion about this post

No posts

Definitely

It also helps square the circle between the RBA and Treasury forecasts

The worse the private sector is, the better the chance the Treasury forecasts for inflation will be met