1. Melbourne Institute’s initial nowcast for Australia’s Q4 GDP growth points to ongoing softness

2. Aussie firms report a significant decline in recruitment difficulty for low-skilled positions (open borders), but not much change for high-skilled jobs

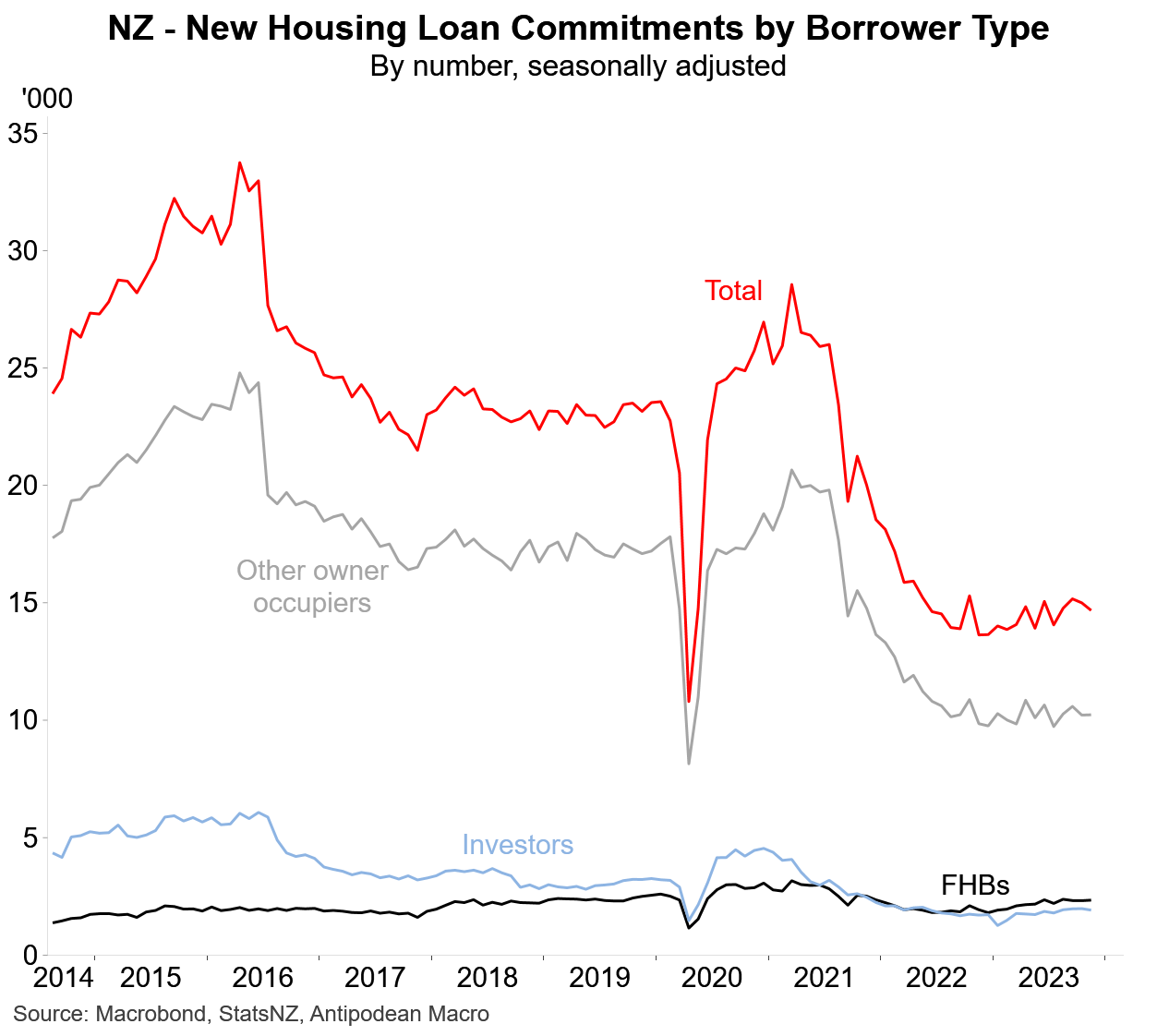

3. The number of new housing loan commitments in New Zealand continued to roll over in November…

…and the value of new housing loans remained very low as a share of outstanding housing credit

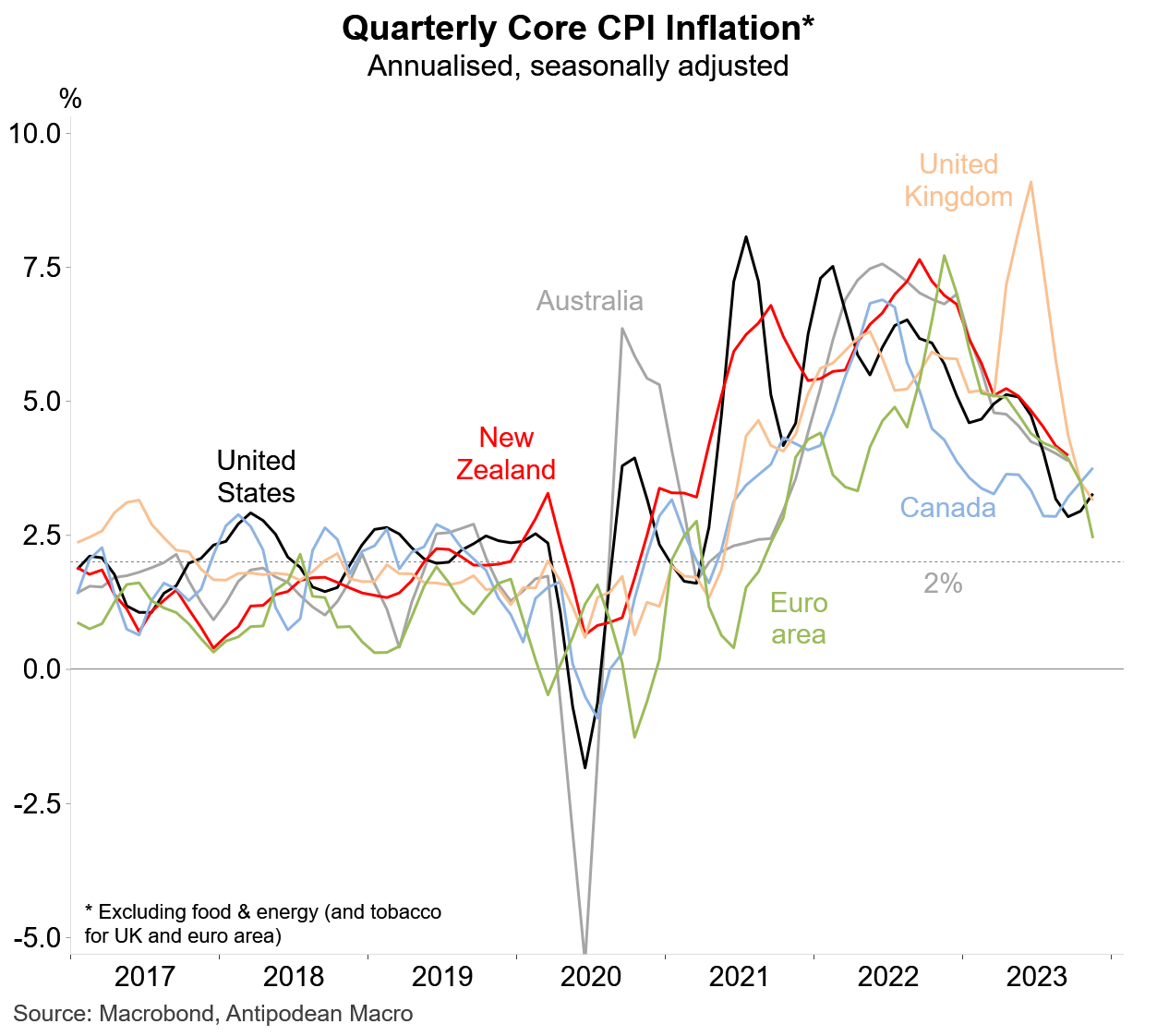

4. CPI inflation (ex food & energy) has declined significantly across several economies, with UK and euro area data out this week showing noticeable disinflation

5. Measures of ‘core’ inflation in Canada for November also showed further disinflation in quarterly terms

6. Services CPI inflation is a real mixed bag across economies - picking up a bit again in some, but falling further in others

7. Measures of actual and expected job mobility in Australia continue to point to less upward pressure on wages growth from workers changing jobs

8. The share of Australia’s labour force that is unemployed because of job loss has increased over the past year (but remains low)

9. Over the year to November, 3 industries - health care, education and public administration - in Australia accounted for two-thirds of total employment growth. Strong government spending, and rebounding international student numbers, have played a role

10. In contrast, weak consumer spending has weighed on employment growth in the retail and hospitality industries

No posts