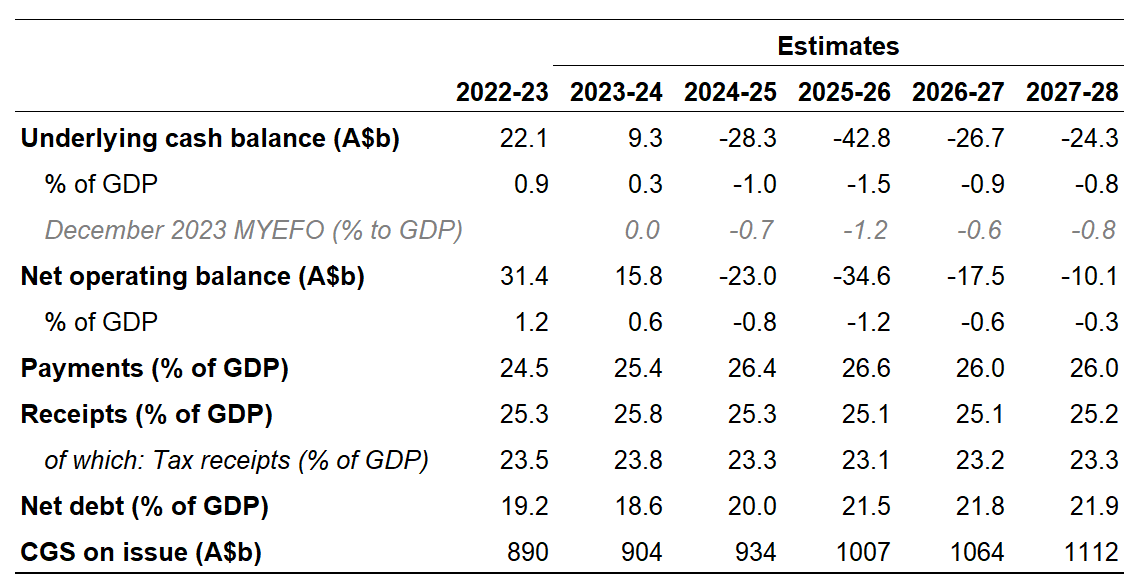

1. The Australian Government expects to record an underlying cash budget surplus of $9.3b (0.3% of GDP) in the current fiscal year to 30 June 2024. Cumulative budget deficits of $122b (~1% of GDP) are then pencilled in for the following four years.

2. Don’t put too much faith in the numbers in the Budget, it’s the 'vibe’ that matters most.

3. Since MYEFO in December last year, the Government has revised up expected spending in the near-term by more than cash receipts.

With the iron ore price still assumed to fall to US$60/tonne, there is always some room for upward revisions to receipts.

4. Australian government debt is expected to rise in the near-term as a share of the economy but net debt is forecast to remain low by international standards, peaking at 22% of GDP.

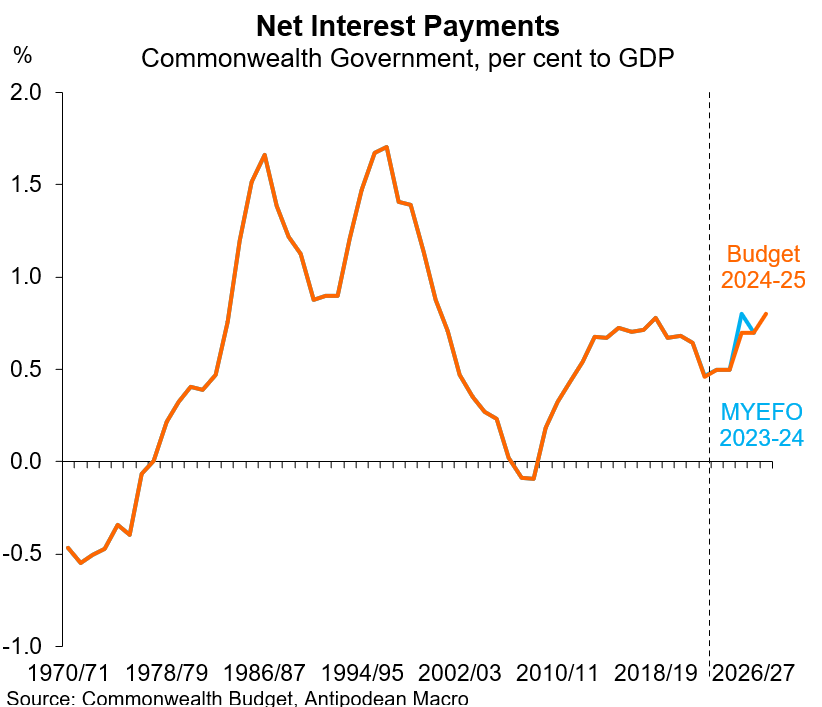

5. Net interest payments on the Australian Government’s debt are still expected to rise.

6. Now, the juicy stuff.

The STRUCTURAL budget balance is expected to swing from a small surplus to sizeable deficits in the next couple of years and then remain in deficit over the forecast horizon.

A simpler way to think about the structural budget deficit is through an unemployment lens.

Forecast budget deficits are large in an historical context given the Government expects the unemployment rate to rise to only 4.5%.

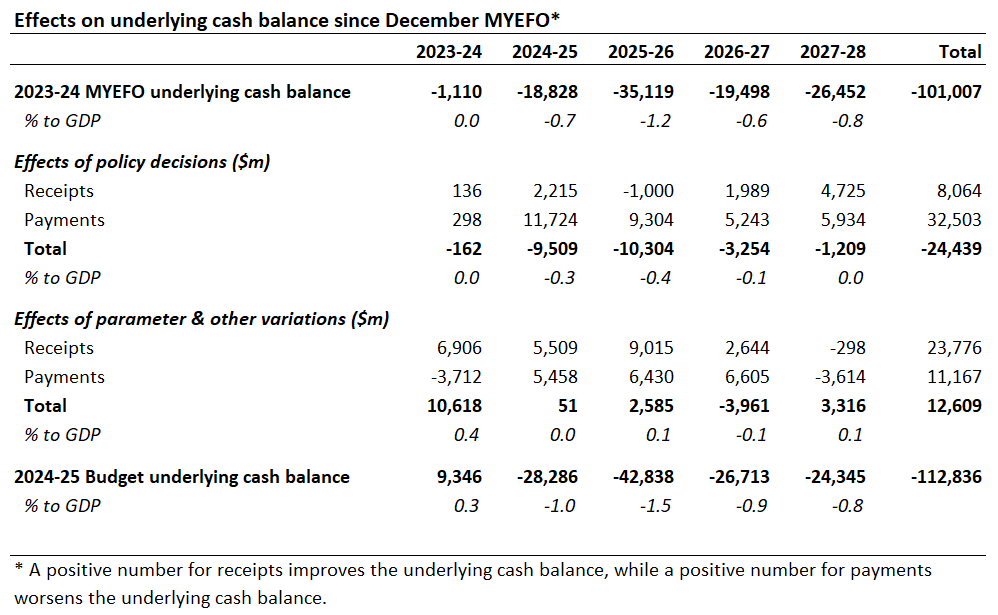

7. Policy decisions since the December MYEFO are expected to ‘worsen’ the budget position by $24.4b over the five years to 2027-28. Nearly $20b of that is in the next two fiscal years.

Parameter and other variations are forecast to improve the cumulative budget balance by $12.6b by 2027-28, with most of that ($10.6b) in the current fiscal year (so it’s largely happened).

NOTE: around half of the (net) policy decisions that are expected to increase receipts are listed as “decisions taken but not yet announced“.

7. In addition to the on-budget policy decisions, the Government has also added to its off-budget policy decisions. These are captured in net cash flows from investments in financial assets for policy purposes - what a mouthful!

Changes in these off-budget policy decisions can have real economy implications. Since MYEFO, the Budget notes that the increase in off-budget financing flows is largely driven by additional equity and a loan provided to Snowy Hydro Limited and an increase in concessional finance for social and affordable housing projects from Housing Australia.

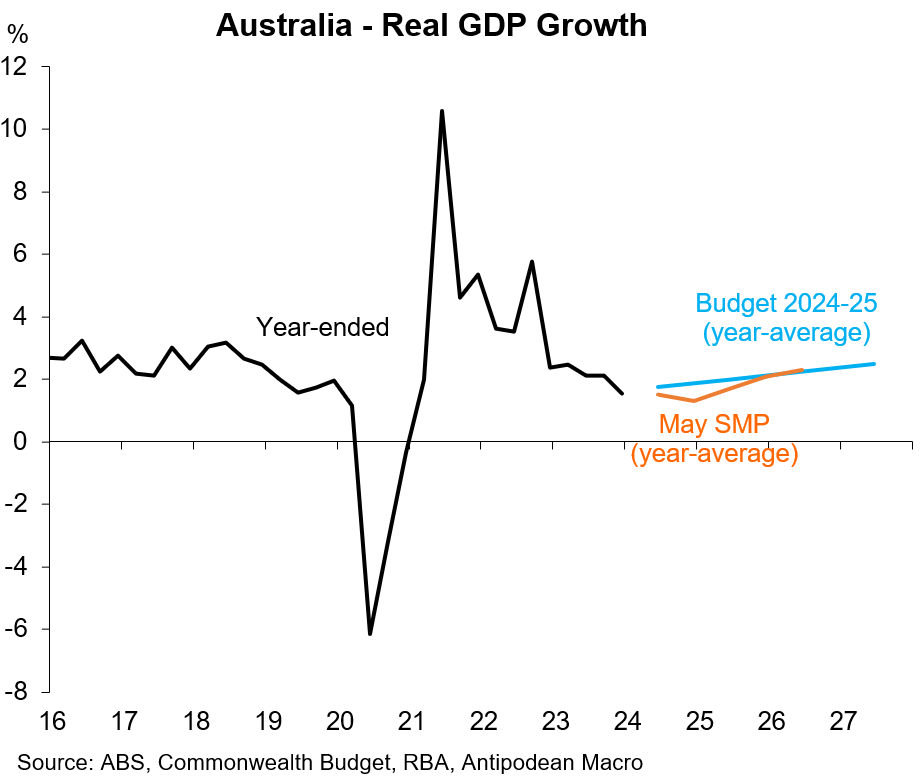

8. Treasury’s GDP growth forecasts are modestly higher than the RBA’s in the near-term, but both can be characterised as soft at best.

9. Nonetheless, Treasury expects a slightly higher unemployment profile than the RBA. If Australia gets away with either profile it’ll be a huge win.

10. As flagged by the Treasurer before the Budget was released, Treasury’s headline inflation forecasts are lower than the RBA’s. This is largely because Treasury has incorporated new energy bill relief and rent assistance from the Federal Government into its numbers.

Treasury expects the energy bill relief and Commonwealth Rent Assistance to directly reduce inflation by ½ppt in 2024–25.

The impact of these measures on underlying inflation will be more muted.

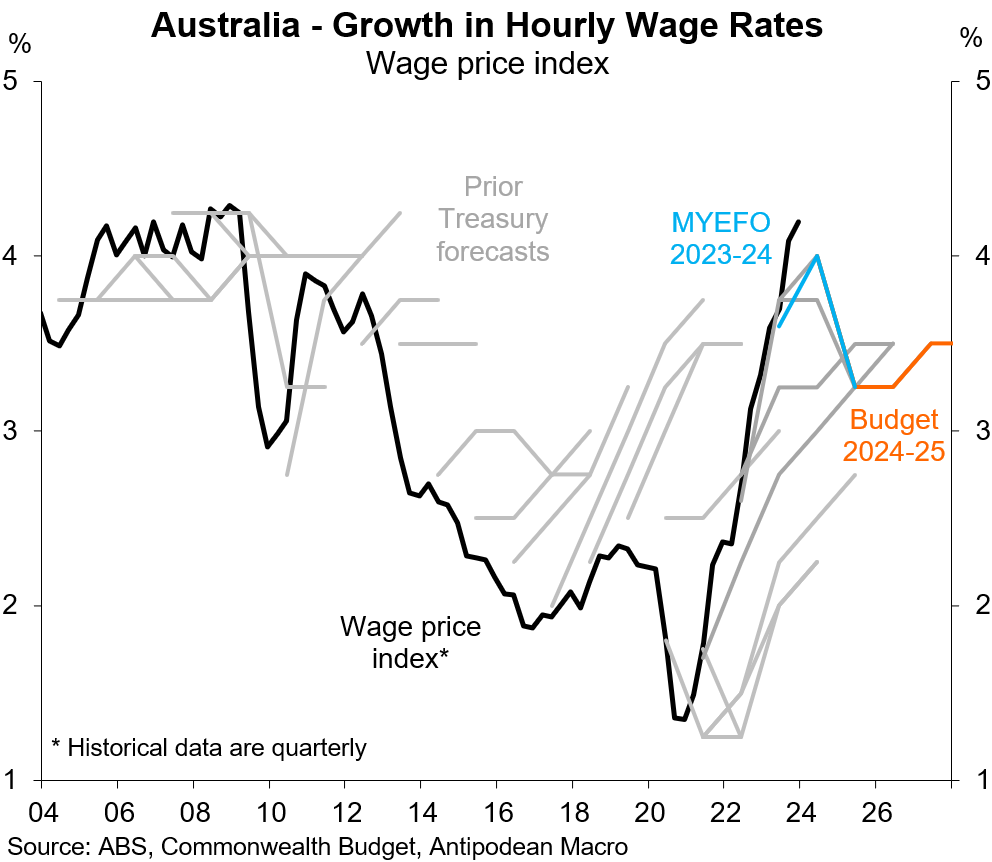

11. Treasury is more downbeat than the RBA about the outlook for growth in hourly wage rates…

…but wages growth isn’t something Treasury (or the RBA) has found easy to forecast at times.

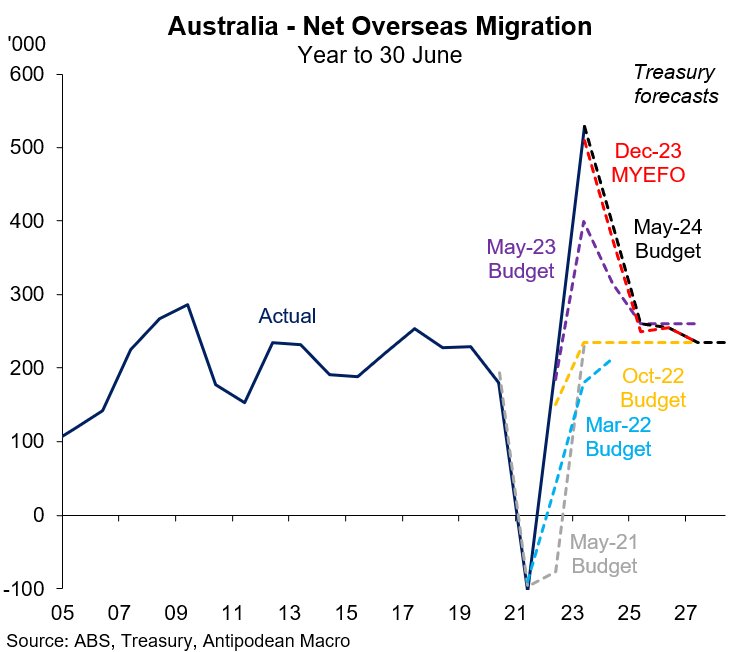

12. Treasury’s net immigration forecasts have been revised a little higher since MYEFO in December.

Discussion about this post

No posts