Aussie Labour Market

Digging beneath the surface

We dig underneath Australia’s labour force headlines by looking at movements of people between employment, unemployment and outside the labour force.

Some key takeaways include:

The share of workers becoming unemployed remains very low but has increased, particularly for males (which has happened during prior downturns).

There has also been a rising propensity for Australians outside of the labour force to move into unemployment.

The lack of full-time employment growth since mid-2023 is largely because of a sharp fall in part-time workers shifting into full-time work (rather than full-timers losing hours and becoming part-time).

Youth labour market conditions have softened. Notably, young ‘outsiders’ - those not in a job - are transitioning into employment at much lower rates amid very sharp growth in the 15-24 year old population.

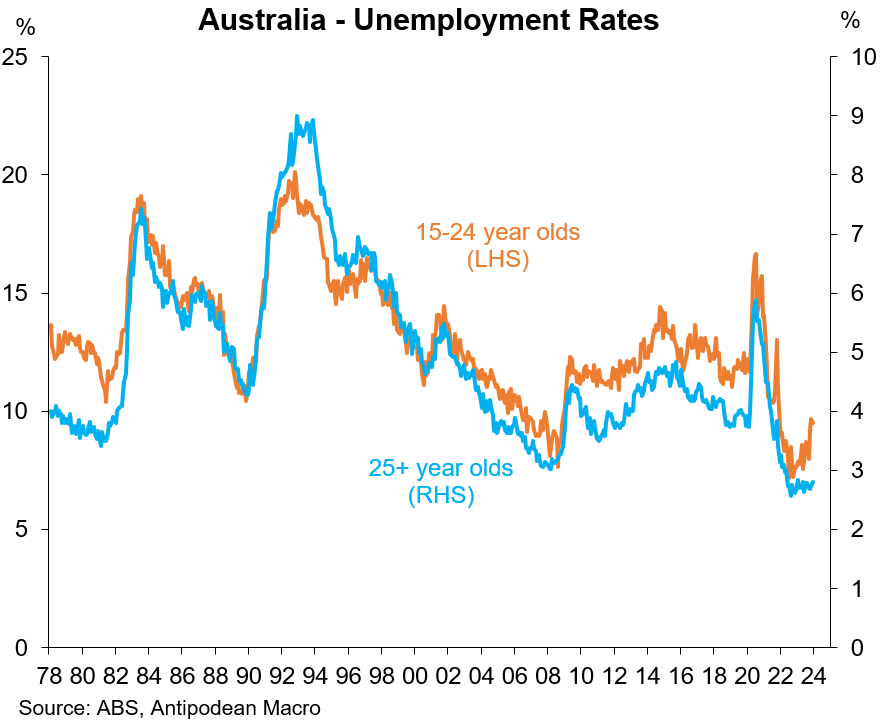

Tight labour market, but easing

The backdrop for Australia’s labour market is that it remains tight but conditions are easing. The unemployment rate has risen ½ppt since late 2022 to a still-low 3.9% and the share of the working-age population in a job has dipped modestly.

The headline figures, however, disguise significant underlying movements in the labour market from month to month.

These changes can be gleaned from the part of the labour force survey sample that is common between months (i.e. not rotated). For example, this ‘matched sample’ shows what share of workers remain in employment, become unemployed or leave the labour force from month to month. The ABS calls these “gross flows” data.

Signs of softness are emerging

The share of Australian workers moving to unemployment remains very low but has increased a little in recent months. This has been most pronounced for males. We watch this closely as it was male workers that experienced more pronounced shifts into unemployment during the GFC and early 2000’s downturn.

The share of workers outside the labour force (NILF) becoming unemployed, while still very low, has also started to increase.

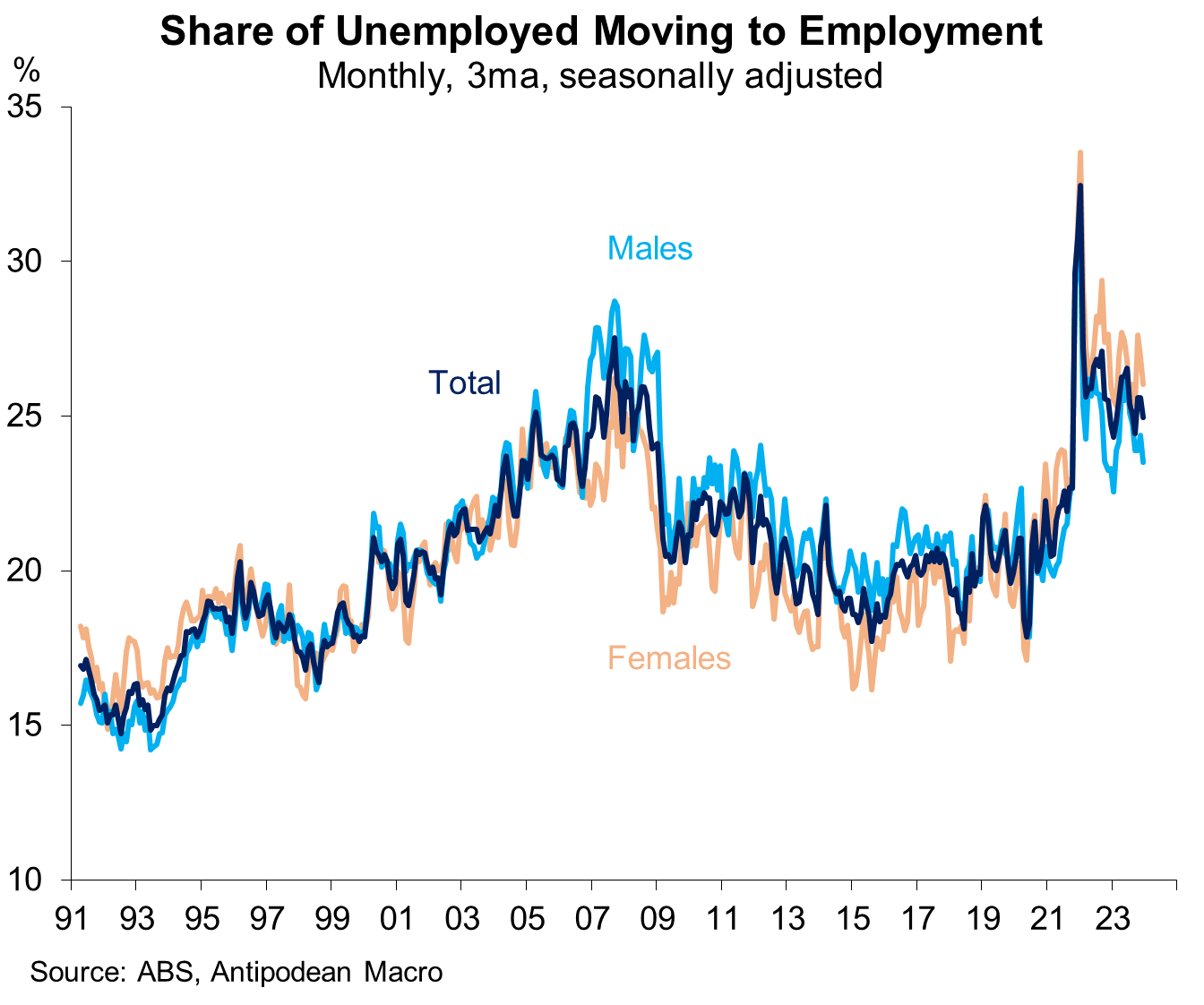

In part this reflects a small decline in the propensity for persons outside the labour force to find employment, particularly for males (note the different scales between the charts above and below). Nonetheless, this share remains at a high level reflecting the relatively tight labour market.

Similar trends are evident for the share of unemployed persons shifting into work - it remains high, particularly for females, but is edging lower.

Part-timers finding it harder to upgrade hours

All of the increase in employment over the second half of 2023 was in the part-time component (i.e. workers on fewer than 35 hours per week in all jobs). As a result, average hours worked have fallen.

These aggregate data, however, do not provide any insight into why full-time employment has been flat.

The gross flows data reveal that there has been a sharp decline in the propensity for part-time workers to move into full-time employment.

At the same time, there has NOT been an increase in the share of full-time workers shifting to part-time work.

Youth labour market conditions deteriorate…

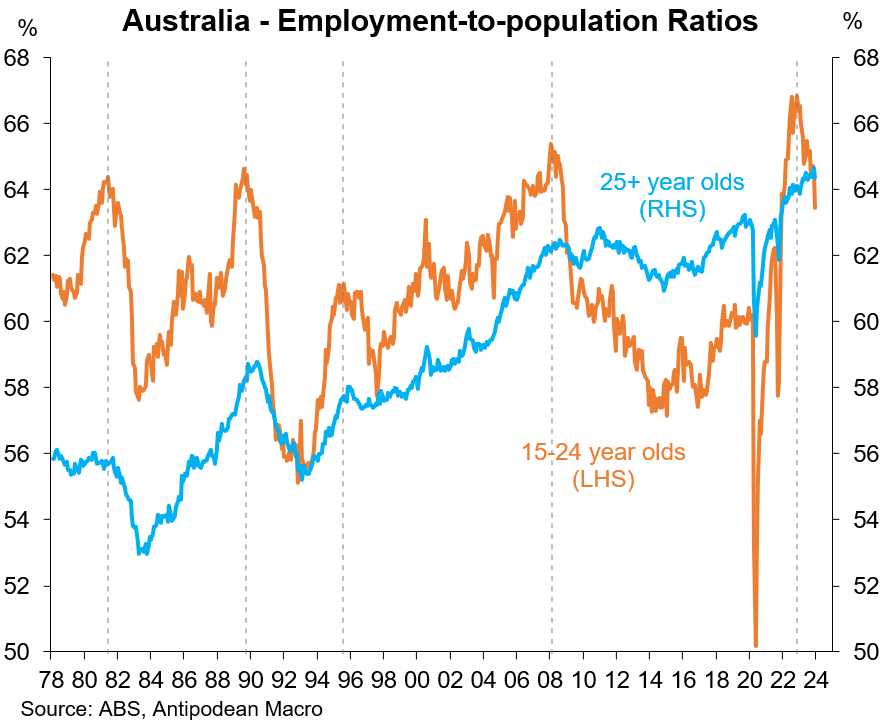

Labour market conditions for 15-24 year olds in Australia have deteriorated.

The youth employment-to-population ratio has fallen sharply after reaching a record high in late 2022. In contrast, the share of workers aged 25+ remains close to an all-time high, and the unemployment rate for this age cohort has broadly flat-lined at under 3%.

Historically, the employment propensity for young workers has typically peaked prior to the employment-to-population ratio for other workers. Hence, it has been a harbinger of broader labour market deterioration.

…but so far it’s more of an issue for ‘outsiders’ than ‘insiders’

Deteriorating youth labour market conditions have so far had relatively little effect on 15-24 year olds already in employment (‘insiders’). The share of 15-24 year old workers remaining in employment from month to month is around a record high. That is encouraging from the viewpoint that young workers aren’t being laid off in droves.

The burden has mostly been felt by young ‘outsiders’ - i.e. persons not in employment - who are are finding it more difficult to find work.

Strikingly, the share of young people transitioning from unemployment or outside the labour force to a job has been falling for several months after reaching record-high levels.

What might be going on here?

First, demand for young workers has fallen amid weaker conditions in retail and hospitality.

Secondly, the supply of labour from 15-24 year olds has also surged as net immigration - including international students and working holiday makers - has bounced back very strongly.

As a result, a rising share of youth have found it more difficult to secure work.

It’s also possible that a higher share of youth don’t want to work, particularly those international students with sufficient resources to not require a local income.