Aussie CPI preview

Australia’s November CPI will be released on 10 January. This release now attracts significant market attention, with the undershoot in the October release sending Aussie bond yields sharply lower.

Here’s a quick summary, with all the detail further below.

We expect year-ended headline inflation to have moderated further from +4.9% in October to +4.4% in November. The risks feel skewed a bit to the downside.

Inflation is expected to have been around +0.4% m/m and a bit below 4% on an annualised 3m/3m basis (down from 5.1% in October).

A higher share of the CPI basket by weight will be updated for November (~68%) compared with October (~59%) and December (~64%).

Importantly, a relatively high proportion of services CPI components are updated in the mid-month of the quarter. These are expected to reveal a slight moderation in quarterly services inflation, but probably not enough to unseat the ‘sticky’ narrative.

For Q4 trimmed mean inflation the RBA has penciled in +1% q/q and ~4.5% y/y.

An upside surprise is a necessary condition for the RBA to hike again in February. That is not our expectation. Our view is that monthly underlying measures will be on track to broadly meet the Bank’s trimmed mean inflation forecast.

We think the Bank will be comfortably ‘on hold’ for a while now and until there are clear signs of labour market deterioration.

Falling global inflation is encouraging

Australia’s CPI inflation has lagged that experienced in other developed economies. In part this reflects the delayed emergence of the Australian economy (and people) from COVID-related restrictions in 2021.

Consequently, the decline in CPI inflation in Australia started later than elsewhere.

Encouragingly, however, the disinflation occurring in the US, Europe and Canada bodes well for further near-term falls in Australia’s CPI inflation, albeit with a lag. This is something that the RBA Board hasn’t missed.

Members also noted that the pace of disinflation in some other countries over recent months had accelerated. If emulated in Australia, this would be helpful in bringing inflation back to target. (December RBA Board Minutes)

Disinflation to have continued

We expect headline inflation to have been around +0.4% m/m (not seasonally adjusted) and +4.4% y/y in November, down from +4.9% y/y in October. An outcome a little below +4% is anticipated on an annualised 3m/3m basis (down from +5.1% in October).

A monthly headline print of +0.4% m/m doesn’t sound low, so what’s going on?

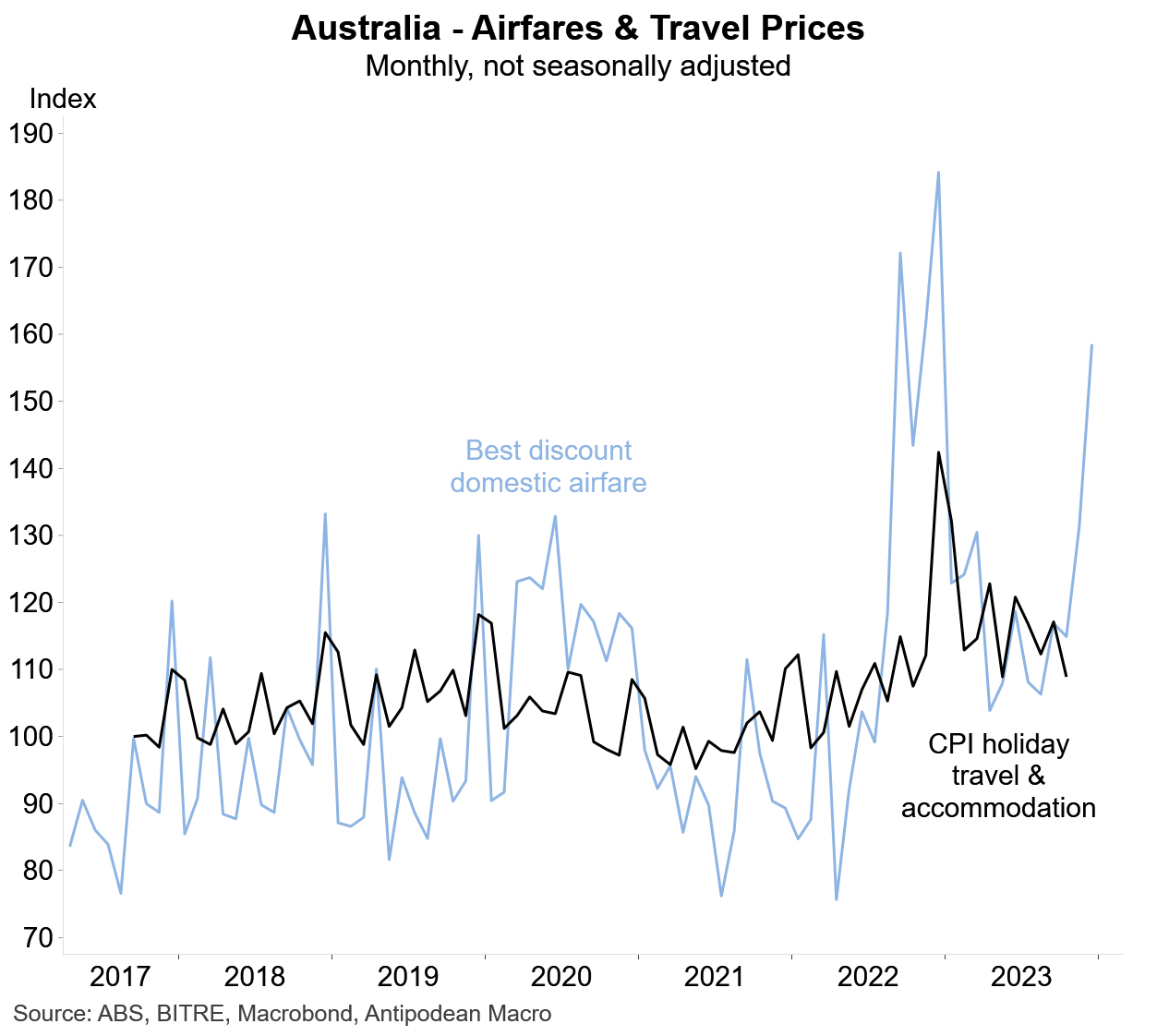

Half of that forecast is accounted for by an expected +0.2ppt contribution from holiday travel & accommodation. Before 2022, travel prices declined in November every year amid weaker seasonal travel demand. But travel prices rose in November last year and the monthly seasonal pattern in 2023 through to October had largely followed the 2022 pattern.

Industry data show a pick-up in domestic airfares in recent months, though our sense is that international airfares have remained under downward pressure.

Pulling all that together, we have assumed a solid rise in travel prices for November but there is considerable uncertainty.

We recommend focusing on the exclusion measures which strip out holiday travel (see below).

Rents inflation (5.8% weight) is expected to have ‘normalised’ at a high rate (~0.7% m/m) in November after higher rates of Commonwealth Rent Assistance depressed the September (+0.3% m/m) and October (-0.4% m/m) outcomes. The ABS noted that rents would have otherwise risen by +0.7% m/m in both of those months.

Other housing categories aren’t expected to have contributed much to monthly inflation. New dwelling purchase prices are likely to have risen only modestly amid weak demand. Electricity prices are assumed to have been little changed amid ongoing quarterly government rebates. We have assumed a solid (seasonal) rise of 2.5% in gas prices. Other housing categories aren’t updated for November.

Sales events in November are likely to have depressed inflation, or led to outright price falls, for some CPI items (e.g. men’s & women’s garments; alcohol).

Note, however, that prices footwear, clothing accessories, garments for infants & children, furniture, household appliances and a range of other household goods are NOT collected in the mid-month of the quarter.

Our tracking suggests that petrol prices fell modestly in November.

A big month for services price updates

Prices for several services categories are updated for November.

Domestic market services categories account for a little more than 20% of the CPI. For November, categories with a combined CPI weight of ~14% are updated (compared with just 2½% for October and 6½% for December).

Meals out & takeaway prices account for half of the domestic market services prices (by weight) updated for November. We have penciled in a solid rise of +1.5% q/q, but this would be lower than the +2% q/q increase in Q3 which occurred alongside the significant rise in award wages. Similarly, we expect some moderation in inflation for other market services prices in November.

Encouraging signs of moderating underlying inflation

The ABS only publishes a year-ended measure of trimmed mean inflation using monthly CPI data which is not very useful for gauging the rate of underlying disinflation around turning points.

Further, the year-ended measure published monthly ‘trims’ at the annual level rather than using higher frequency seasonally adjusted data as per the quarterly trimmed mean measure. So it’s a different beast.

Partly for those reasons, we place as much emphasis on the higher frequency seasonally adjusted measure of CPI excluding ‘volatiles’ and travel as a guide to underlying inflation.

We expect this measure to have remained relatively well behaved in November after moderating in September and October.

Moreover, the expected signal from this measure of underlying inflation suggests things remain broadly on track to achieve the RBA’s +1% q/q trimmed mean inflation forecast for Q4 as a whole.

Something we are watching closely, however, is what firms are reporting in the business surveys on inflation. The NAB survey suggested that inflation remained elevated through to November and we’ll need to see this measure come down to be convinced that the disinflationary trend is in tact. The next update is on 23 January.